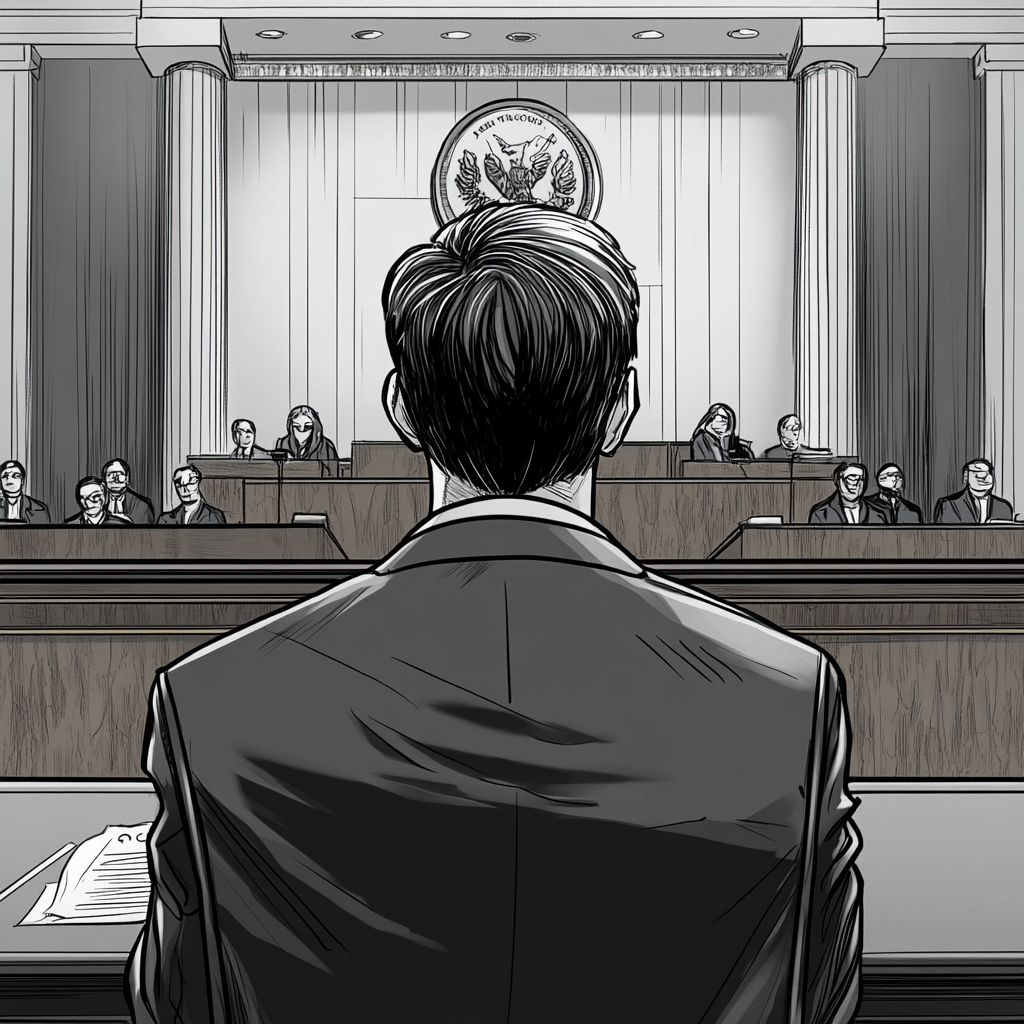

SEC vs OKX: Unlicensed Operations Allegation

In the buzzing world of cryptocurrency, where fortunes can rise and fall in a heartbeat, intrigue is, if not the norm, certainly the spice of life. Enter the latest plot twist: a juicy legal drama starring the global cryptocurrency exchange OKX, which has recently found itself at the center of a brewing storm that could shake the very foundations of digital asset trading. The Thai Securities and Exchange Commission (SEC), in a dramatic turn of events, has slapped OKX with a criminal complaint. Why? Well, the exchange has allegedly been operating without the necessary licenses since that fateful date of October 15, 2021. Buckle up; we're diving into the details.

In classic regulatory fashion, the SEC’s move is part of a broader crackdown aimed at wrangling in the somewhat wild beast that is the cryptocurrency market. Thailand has been following a trail, which started with similar actions against heavyweight exchanges like Binance and Bybit. It's less about the money (though that's no small consideration) and more about putting the proper safety measures in place—after all, investors deserve to be protected, right?

So, what exactly is OKX accused of? According to the SEC, the exchange—a creation of Aux Cayes Fintech Co. Ltd.—has been peddling digital asset exchange services to Thai users without regulatory approval. They were charging transaction fees and marketing their offerings as if everything was above board. Spoiler alert: it wasn't. This isn't just a slap on the wrist; it’s a serious legal offense that could get them entangled in criminal penalties. And they’re not in this alone; nine individuals have been dragged into the fray for promoting the notorious platform on social media. Yes, that includes platforms like Telegram, X (formerly Twitter), and Line OpenChat. They’ve been accused of helping OKX forge a path into the Thai market—a pathway that could lead to financial risks for unsuspecting investors, thanks to insufficient know-your-customer (KYC) and anti-money laundering (AML) provisions.

The case has been tossed into the lap of Thailand's Economic Crime Suppression Division. Now, picture this: a team of investigators diving deep, analyzing the evidence, and determining the next steps. It’s like a legal thriller unfolding in slow motion, and if convicted, OKX along with its co-conspirators could be facing some serious repercussions. Think imprisonment ranging from two to five years, fines lurking between 200,000 to 500,000 baht (which translates roughly to $5,890 to $14,630), not to mention a daily fine of 10,000 baht ($293) accruing until compliance is achieved. It’s a scene straight out of a crime movie—no more digital playground for them!

But hold on; this isn't OKX's first tango with regulatory issues. The exchange has previously attracted scrutiny on a global scale, notably from the U.S. Just recently, they agreed to a staggering $504 million settlement for violating U.S. anti-money laundering laws. This ugly history highlights a significant risk: operating in jurisdictions without securing the right licenses can come back to bite you—hard.

In trying to salvage their reputation, OKX has made some high-profile moves to boost their compliance game. They’ve brought on board seasoned legal advisors, including former New York Governor Andrew Cuomo, and appointed Linda Lacewell, the former Superintendent of the New York Department of Financial Services, as their Chief Legal Officer. It’s as if they’re building a legal dream team—each member a formidable tactician in the chaotic world of crypto regulations. One must wonder, though, can a glittering roster save them from the legal inferno that now looms ahead?

The SEC's stiff actions against OKX serve as a wake-up call for investors, a clarion call to tread carefully when navigating the murky waters of unlicensed cryptocurrency exchanges. Ignorance in this wild-west finance world can be perilous, exposing traders to a buffet of scams and significant financial headaches. Therefore, it’s paramount for every investor to do their homework—check licensing statuses and ensure they’re engaging with platforms that are operating within the bounds of the law. A little due diligence can save you from heartache that comes with unpleasant surprises.

As we watch the cryptocurrency market morph and evolve, one thing is certain: regulatory bodies aren't sitting idly by. Their clampdown efforts are intensifying, ushering in a new wave of compliance checks that will likely embed themselves into the operational framework of exchanges harboring any intent to engage in checkered operations. Exchanges are in the spotlight, and those lacking the necessary licenses can expect to be scrutinized. Tuning into these developments is more crucial than ever for those riding the cryptocurrency wave.

If you have your finger on the pulse of the cryptoverse, it’s time to sharpen your focus and catch up on all the unfolding drama in this sector. Stay informed, stay alert, and protect your investments like the precious gems they are.

Want to stay up to date with the latest news on neural networks and automation? Subscribe to our Telegram channel: @channel_neirotoken